Most single tenants renting privately in London are now paying more than half of their monthly salary on average to rent a one-bedroom property.

Research undertaken by the property website Sellhousefast.uk which analysed the latest data from the Office of National Statistics (ONS) found that the average rent for a one-bedroom property in London is now almost £1,330 per month.

Despite having the highest costs of any housing type, the private rented sector has the worst property standards. In February 2016, it was reported that 60% of London renters are forced to live in unacceptable conditions. Private renters are also one of the most deprived groups with almost 25% of households at risk of fuel poverty.

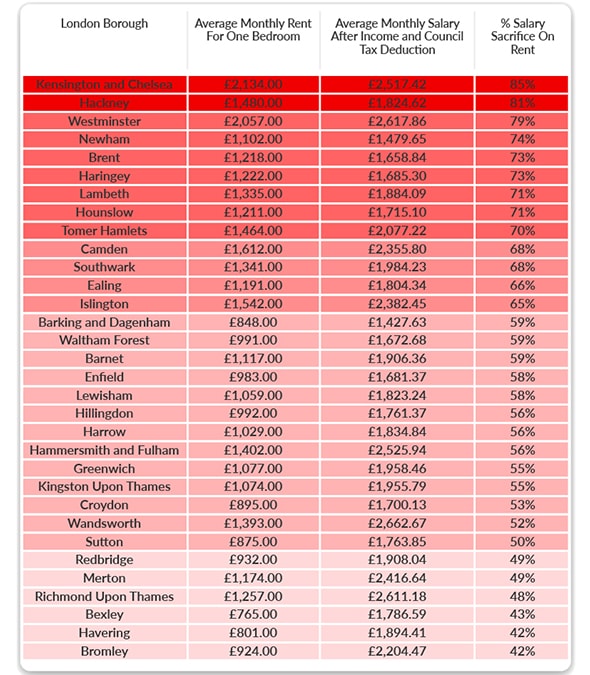

ONS data revealed that single tenants in 25 of London’s 32 boroughs are spending more than half of their monthly salary – after income and council tax deductions – on rent for a one-bedroom property.

Unsurprisingly, housing affordability is worst in prime areas of the capital, with those renting a one-bedroom property in Kensington and Chelsea paying the equivalent of 85% of the average London monthly salary on rent.

The cheapest accommodation for single tenants was in the boroughs of Bromleywell and Havering with the average rental cost for a one-bedroom home coming in at 42% of monthly salary.

Robby Du Toit, managing director of Sell House Fast commented: “As demand has consistently exceeded supply over the last few years, Londoners have unfortunately been caught up in a very competitive property market where prices haven’t always reflected fair value. This notion is demonstrated through this research whereby private rental prices in London are certainly overstretching single tenants; to the extent they must sacrifice over half their monthly salary.

“For those single tenants with ambitions to climb up the property ladder – their intentions are painfully jeopardised, as they can’t set aside a sufficient amount each month to save up for a deposit or explore better alternatives. It’s not only distressing for them but worrying for the property market as a whole – where the ‘generation rent’ notion is truly continuing too spiral further.”