London home sellers are having to cut asking prices for their homes and are offering greater discounts as high house prices and brexit uncertainties impact demand.

Lucian Cook, residential research director at Savills claims that price cuts seen in prime central London following the Brexit vote are now filtering through to outer boroughs. “Affordability issues are now a problem after a decade of house-price growth, and buyers are finding they increasingly come up against mortgage-lending limits.”

The latest slowdown in London house price growth comes after home prices in the capital have surged by around 86 percent since 2009. London house prices are now 14.2 times the average buyer’s gross salary according to the research firm Hometrack. This is the highest house price to salary ratio on record and more than double the rate for the UK as a whole.

Data released by the Council of Mortgage Lenders also shows that there has been a fall of 12 percent in the number of mortgages advanced to first-time buyers in London. High London asking prices have in many cases now exceeded lending limits allowed to banks under rules set by regulators in 2014.

Central London hit hardest

The house price decline has been most notable in central London. Average prices were cut by 8.2 percent in Kensington & Chelsea on an annualized basis compared with 7.8 percent in July. Westminster and Wandsworth have been similarly affected recording 7.7 percent and 7.1 percent declines respectively.

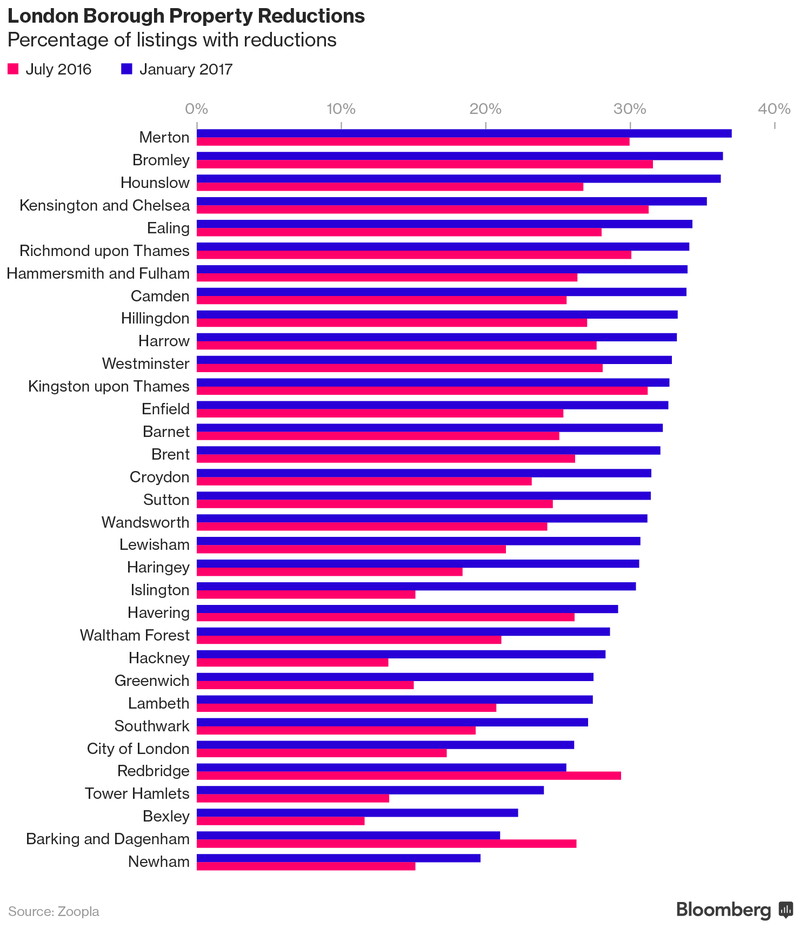

In an apparent reversal of typical trends, outer boroughs have been less affected than prime central London. The percentage of sellers cutting asking prices in January rose in all but two of the capital’s 33 boroughs compared with July.

Listings reductions

According to the property website Zoopla, 37.1 percent of property listings in Merton have been reduced. John J. King, managing director at broker Andrew Scott Robertson added that sales are down “about 25 percent in the past six months, as they were already affected by stamp duty and the referendum made things worse.”

In Kensington and Chelsea 35.4% of listings have been reduced. Estate agents attribute the fall to changes in stamp duty and the effects of the Brexit vote. However, the house price declines may already be leading to greater interest in buying in the borough. Toby Whittome, a broker at real estate agent Jackson Stops & Staff, claims that “applicants looking to buy are up nearly 40 percent in January, but that doesn’t necessarily result in sales, as people are hoping and waiting for some good news about stamp duty and clarity over the possible impact of the referendum.”

Ealing has also seen a considerable number of price reductions. Following five to six years of steep price increases, 35.4 percent of listings are now reduced. According to Alex Jerram, a broker at Dauntons, a two-bedroom new build in the borough now costs the same as one in Pimlico. “You cannot justify asking the same price for a property in greater London as one in central London. If sellers really need to sell, they have to reduce prices.”

The Renters Alliance helps renters with bad landlords and letting agents. If you have a story you would like to share, please contact the National Renters Alliance through our website or email us at contact@nralliance.co.uk