Buy-to-let landlords are buying more properties outside London following the 6th consecutive month of rent falls in the capital according to the UK’s largest estate agent, Countrywide.

Buy-to-let landlords are buying more properties outside London following the 6th consecutive month of rent falls in the capital according to the UK’s largest estate agent, Countrywide.

Fifty-per-cent of London buy-to-let landlords are looking to buy properties outside London this year according to Countrywide’s new figures. In 2016, London landlords purchased over 22,000 homes outside of the capital – a seven-fold increase on the 3,311 recorded in 2010 when Countrywide first began keeping records.

In April, just 12 per cent of London homes were sold to buy-to-let landlords which is close to a record low.

Countrywide says that London landlords are increasingly looking to northern England for buy-to-let properties with Liverpool becoming a particular hot-spot in the buy-to-let sector.

Landlords looking further afield hope to benefit from better yields and lower stamp duty. Average stamp duty currently stands at £40,000 in the capital which falls to £6,300 outside of London.

Around 9 per cent of buy-to-let properties in the north were sold to London landlords and 26 per cent of London landlords picked up property in the East of England.

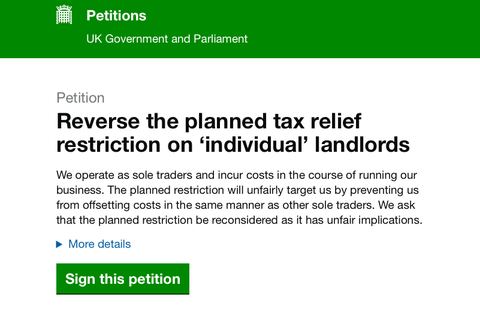

Johnny Morris, Countrywide’s research director, said: “In response to slower price growth and government tax hikes, London landlords are looking further than ever to find a return.

“Lower entry costs and higher yields outside of the capital are enticing investors to look further afield than they have previously.

“Rental growth remains low across Great Britain. Mostly driven by London where rents have fallen for the sixth consecutive month.

“The repercussions of the stamp duty rush are still playing out in the rental market as stock levels continue to remain high.

“But with fewer investors buying in the capital we will likely see stock levels fall, driving future rental growth.”

The Renters Alliance helps renters with bad landlords and letting agents. If you have a story you would like to share, please contact the National Renters Alliance through our website or email us at contact@nralliance.co.uk